41+ can you write off your mortgage interest

Web Line 1. You may still be able to.

Arrow Charm Necklace Offe Market

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

. Enter the total square footage of your home. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web If your adjusted gross income AGI is below 100000 50000 if married and filing separately you can deduct your mortgage insurance premiums in full.

At least in most circumstances you can. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web The interest portion of your monthly mortgage payment isnt the only type of interest youre permitted to deduct from your annual tax bill.

Divide line 1 by line 2. Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up. Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations.

Web IRS Publication 936. However if your property operates as a. In addition to itemizing these conditions must be met for mortgage interest to be.

Web Can You Write Off Mortgage Interest. Web You cant deduct the principal the borrowed money youre paying back. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

This means when you. Web Most homeowners can deduct all of their mortgage interest. Enter the total square footage of your home office.

Web The interest you pay for your mortgage can be deducted from your taxes. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Web You cant deduct home mortgage interest unless the following conditions are met.

Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040.

You see in the US mortgage interest is considered tax-deductible. For married taxpayers filing a separate. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000.

Web If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property. You can also deduct. The write-off is limited to interest on up to 750000 375000 for married-filing.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat. The total is the.

Web If your home was purchased before Dec.

Mortgage Interest Rates Housing Finance Capital Markets Khan Academy Youtube

Mortgage Interest Deduction Or Standard Deduction Houselogic

41 Things To Do In Alpharetta Ga That We Re Obsessed With And You Will Be Too

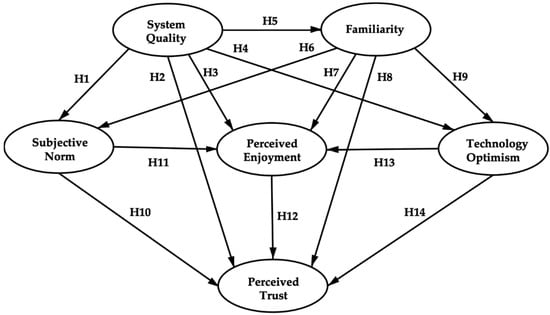

Sensors Free Full Text What Influences The Perceived Trust Of A Voice Enabled Smart Home System An Empirical Study

Tenancy Agreement Template 41 Free Word Pdf Documents Download

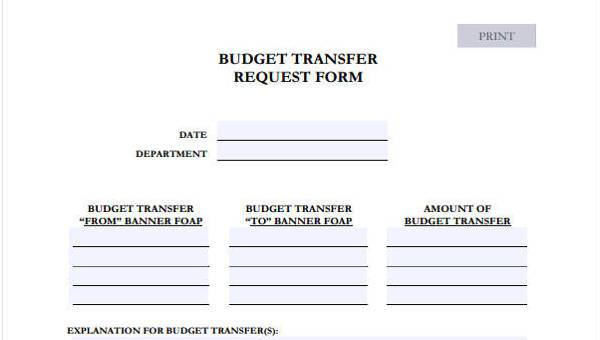

Free 41 Budget Forms In Pdf

Mlm Facebook Posts That Work In 2023 41 Post Ideas Matt Zavadil

How To Sell A Car In 5 Simple Steps Wealth Of Geeks

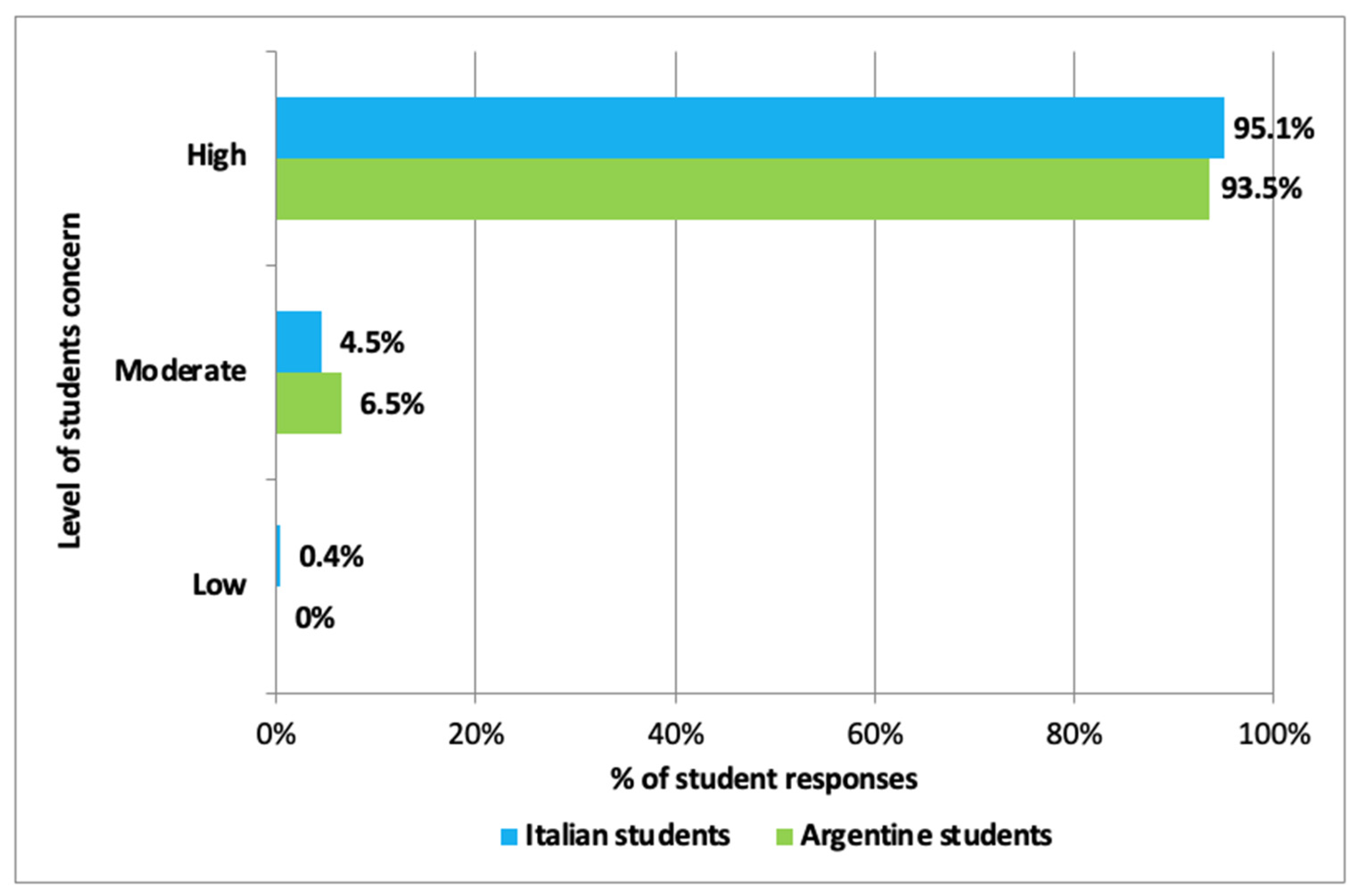

Sustainability Free Full Text The Knowledge And Perception Of Sustainability In Livestock Systems Evidence From Future Professionals In Italy And Argentina

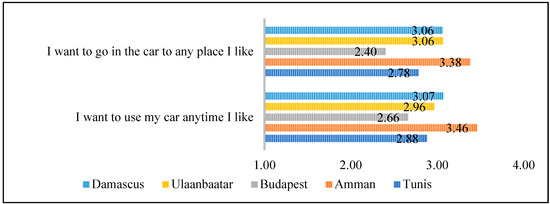

Sustainability Free Full Text Urban Congestion Charging Acceptability An International Comparative Study

41 Application Letter Templates Format Doc Pdf

House For Sale In Thiruvattiyur Chennai 41 House In Thiruvattiyur Chennai

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Hacks To Painlessly Pay Your Mortgage Off Early

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Ralph 124c 41 Dreame

The Gi Bill It S History Iterations And Economic Impact Grin